Investment in new fossil fuel production and unabated coal power needs to end this year if the global energy sector is to transition to net-zero emissions by 2050, a recent report by the International Energy Agency (IEA) argued. A net-zero energy sector is viable but requires an “unprecedented transformation” in the way energy is produced, the IEA said.

Momentum for this global energy transition received a major boost on September 21 when China, the last major public financier of overseas coal power, pledged to cut support. Addressing the UN General Assembly in New York, China’s president Xi Jinping also promised backing for developing countries in their pursuit of low-carbon development.

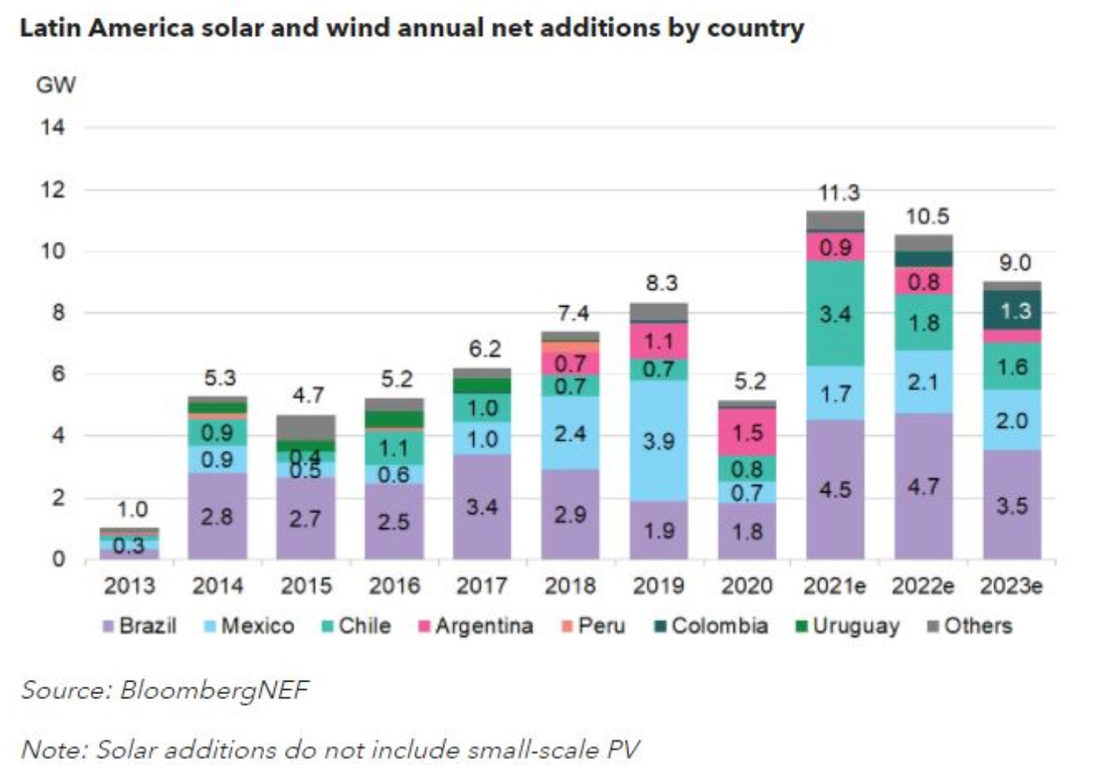

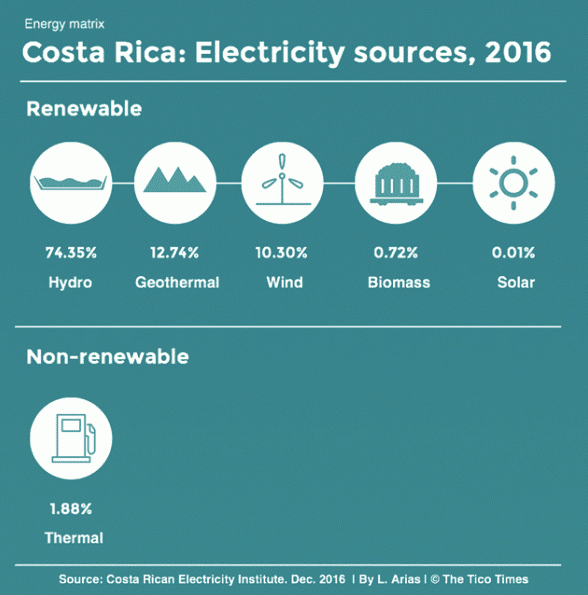

While slower than other developing regions, Latin America’s energy transition is underway, with unconventional renewables - namely solar, wind, and geothermal - growing their share in countries’ energy mixes. Chile, Uruguay and Costa Rica are among those leading the way and have invested heavily in unconventional renewable energy in recent years. Still, moving away from fossil fuels is proving difficult for a region that derives 75% of its primary energy supply from non-renewables.

New Interactive Map

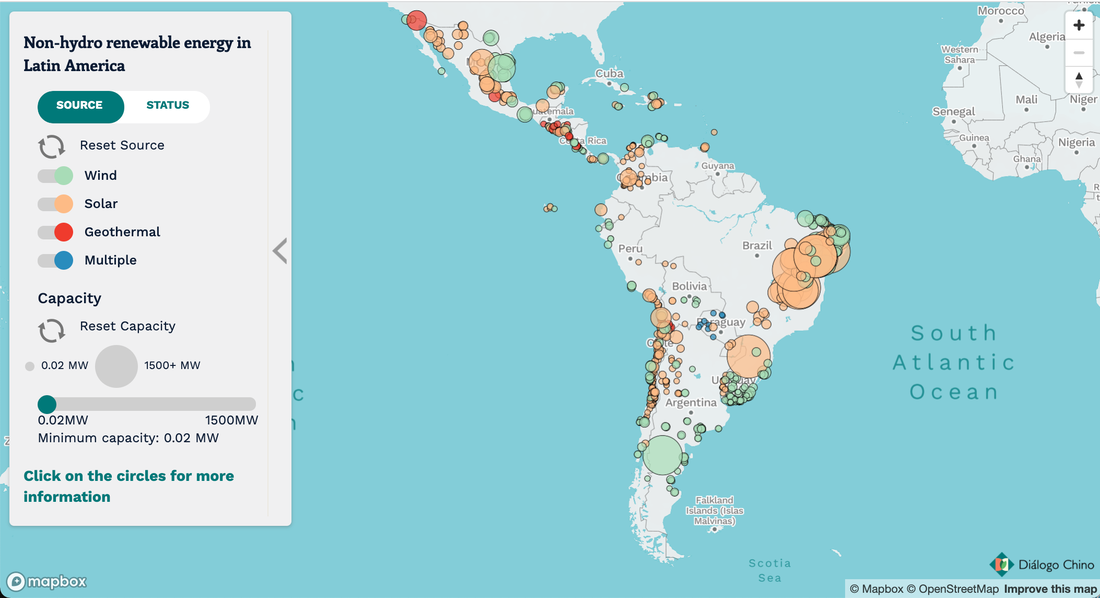

With the region needing to accelerate the clean energy transition and attract financial support for its efforts, Diálogo Chino presents a unique interactive map that plots all of Latin America's networked wind, solar and geothermal energy projects, detailing their installed energy capacity, operational status and ownership.

The data, which was compiled by cross-checking information from state sources, operating companies, industrial guilds and press releases, is intended to serve as a reference point for those hoping to understand Latin American countries’ progress in the clean energy transition. The information on the locations, financial backers and power sources helps build up a clearer picture of the main motors behind it.

Latin America’s renewable energy transition

Our map plots 850 non-hydro renewable energy plants in 24 Latin American and Caribbean countries for which we were able to collect data. For Brazil and Mexico, we set the minimum installed capacity for a project’s inclusion in the dataset at 50MW, owing to the sheer number of smaller projects. Of our total, solar power accounts for 49% while 46% are wind. The remainder is geothermal. More than three-quarters of the projects are owned by private companies. Chile accounts for almost a quarter of all projects on our map (24%), followed by Brazil (21%), Mexico (14%) and Argentina (9%).

Over 80% of Chile’s plants are solar. In Uruguay, wind accounts for the same share. Argentina has a more even distribution, with 60% wind and 40% solar. These three countries have seen a big push for renewable energy in recent years, including the inauguration of Cauchari, Latin America’s largest solar plant - for now.

Brazil’s northeast is seemingly on the cusp a solar revolution, with seven projects with an installed capacity of 1GW or more in the pipeline, including a major cluster in Juazeiro, Bahia, which has ideal climatic conditions, and the largest, Aurora Energia’s 5700MW plant in Matias Cardoso, Pernambuco. These are also located within the Caatinga biome. 86% of finance for wind and solar projects in Brazil comes from the private sector

Private capital is also leading the renewable energy transition in Brazil, financing 154, or 86%, of all projects. Only 8% of finance comes from state-owned companies – either Brazilian or Chinese. China is the only foreign country providing state finance to companies investing in solar and wind projects above 50MW in Brazil. In the Amazon region, Brazil has no projects of this size.

Mexico has a large concentration of wind farms in the south of Oaxaca state and most farms are located in the Yucatán peninsula in the eastern part of the country. Solar projects run down the middle of Mexico and also the north, where there is high long-term potential for photovoltaic power, according to the Global Solar Atlas. Despite high-levels of solar irradiation in such states as Sinaloa, there are no solar plants. Nor are there wind projects. In these states, governance is weak and security is a major concern.

The Andean region’s energy transition appears to be progressing slower than other Latin American sub-regions. Peru’s Amazon has only one renewable energy plant; the Atalaya Photovoltaic Solar Power Plant, while all others are located on the southern coast of the country, in the desert that extends into Chile.

Set to be inaugurated in 2023, Bolivia’s 100MW Laguna Colorada Geothermal Power Plant will be the largest renewable energy project in the country, generating 50% of the country’s non-hydro renewable energy. All projects - operational or under construction - are in the hands of ENDE, Bolivia's national electricity company.

Colombia has 38 projects under construction but only one currently operational wind plant, on the northern tip of La Guajira department. There have already been reported conflicts with indigenous communities over wind development in Colombia, which is set to expand considerably. Over the border in Venezuela, one single plant represents the country's only operational unconventional energy project. The country derives around 70% of its energy from the Guri hydroelectric plant.

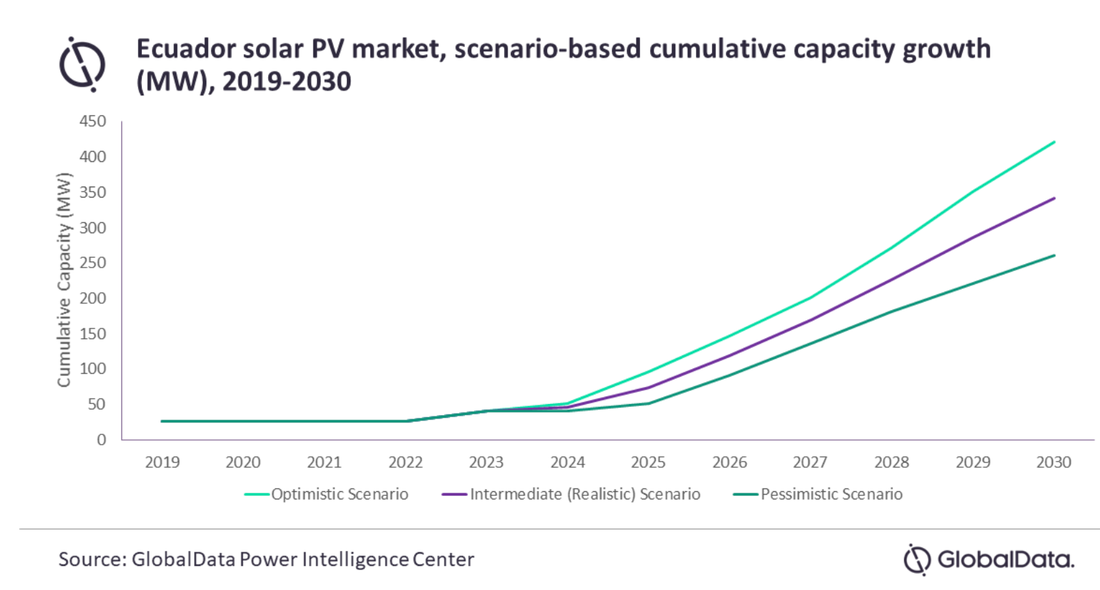

Ecuador’s Galapagos Islands stand out in deriving all their energy needs from wind and solar energy projects.

Renewable energy goals

It is technically and economically feasible to scale up renewable power in Latin America. Under a scenario set out by the International Renewable Energy Agency in which the global energy system is consistent with the Paris Agreement, 93% of the region’s electricity would come from renewable energy in 2050.

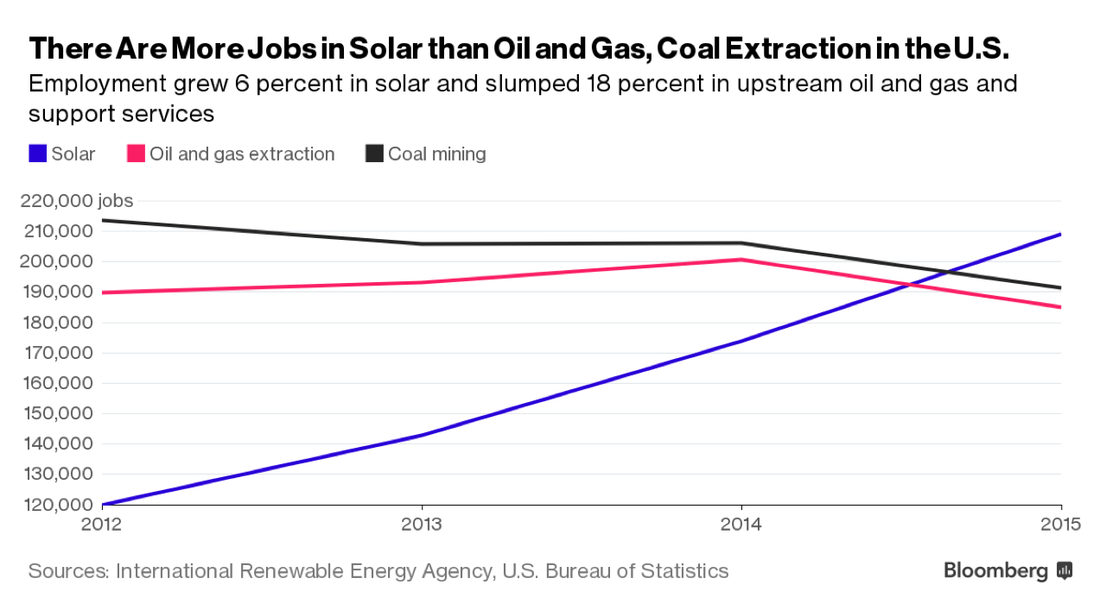

This energy transition would not only clean up the grid but also boost the economy. A report last year by the Inter-American Development Bank (IADB) found that decarbonisation will generate 15 million new jobs overall and an additional 100,000 full-time jobs in the renewable electricity sector by 2030, compared to projections based on current trends.

There are many questions to be answered around China’s signal of greater support for renewables in developing nations. For example, it is as yet unknown whether the pledge includes hydropower. For Latin America, it could represent an opportunity to capitalise on the availability of new finance that enables it to reach its decarbonisation goals.

Data compiled by Emilio Godoy, Damián Profeta, Jorge Chávez, Sarita Reed and Vinícius Henrique Fontana, with support from Robert Soutar, Fermín Koop, Alejandra Cuéllar, Jack Lo, Lívia Machado Costa and Flávia Milhorance. Map designed by Julia Janicki.

RSS Feed

RSS Feed