The guide "shows how sustainable energy investment can support Caribbean countries to 'Recover Better’ [from the COVID-19 pandemic] and accelerate a clean energy transition to deliver long-term economic growth and new jobs." The following information is from the press release. The full guide is available here.

"According to the guide, the Caribbean region has a historic opportunity to transition from a fossil fuel-based economy to one powered by resilient, decentralized, clean energy. Currently, the Caribbean power sector is heavily dependent on imported fossil fuels and has some of the highest electricity costs in the world. Under an ambitious recover better strategy, Caribbean countries should aspire to invest as much as 25 percent of their stimulus budgets for on-grid and off-grid renewable energy – through a combination of solar, hydro and wind. Accelerating this transition will also generate significant economic growth, with an estimated annual saving of USD 9 billion in fuel costs if all 31 countries in the Caribbean move to 90 percent clean energy by 2030."

'This investment will also help grow the region’s resilience and energy security to deal with the impacts of climate change and extreme weather, which Caribbean countries are particularly vulnerable to. In addition to high electricity costs, centralized electricity systems have shown to be weak during extreme weather events with devastating effect. Off-grid systems, such as solar-based mini-grids, can keep critical services like health facilities connected when the centralized system fails. A renewable energy future also helps support faster progress on the Paris Agreement."

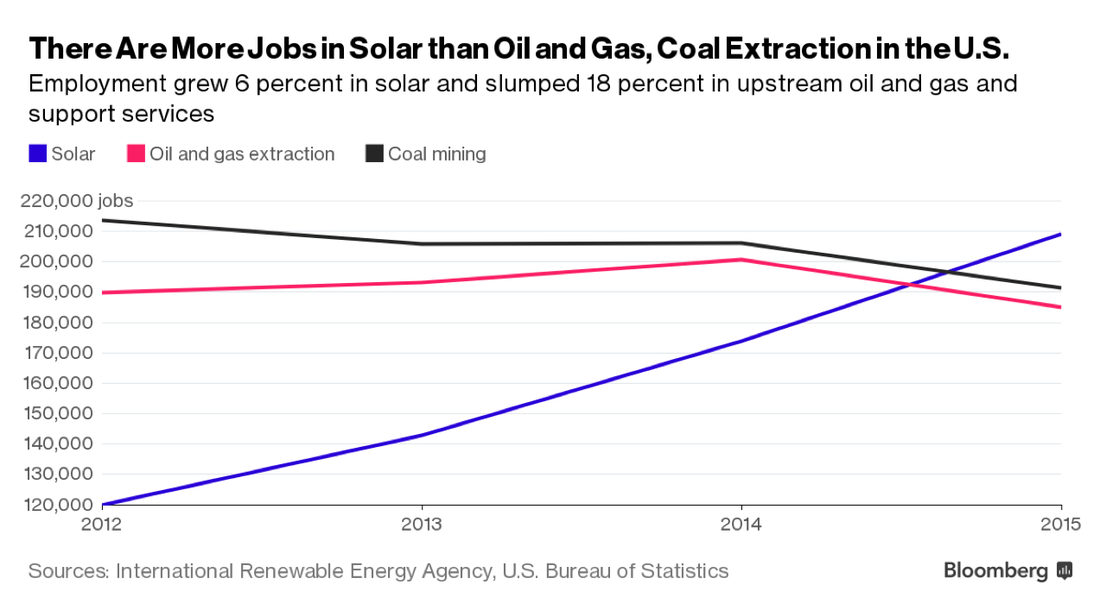

“'As Caribbean countries continue to respond to the impacts of COVID-19, they have a once-in-a-lifetime opportunity to ‘Recover Better’ with sustainable energy to support greater energy resilience and security,' said Damilola Ogunbiyi, CEO and Special Representative of the UN Secretary-General for Sustainable Energy for All and Co-Chair of UN-Energy. 'By investing in sustainable energy, countries can use this moment to move away from a fossil fuel-based economy to one powered by clean energy that will provide cheaper electricity for consumers and help support the vital tourism industry in the region.' Countries that commit to an ambitious recover better strategy will benefit from increased GDP, affordable energy provision, and improved gender and health outcomes. Investment in distributed energy resources will not only benefit the electricity systems and communities, but also support tourism across the region – a core industry for Caribbean countries. From supporting food cold chains to powering businesses, local renewable resources and energy efficiency measures can enhance competitiveness, lower energy costs, increase resilience and stimulate the local industry.

"The new Recover Better with Sustainable Energy Guide from SEforALL highlights key policy measures Caribbean governments should adopt to ensure a successful energy transition in this period, including:

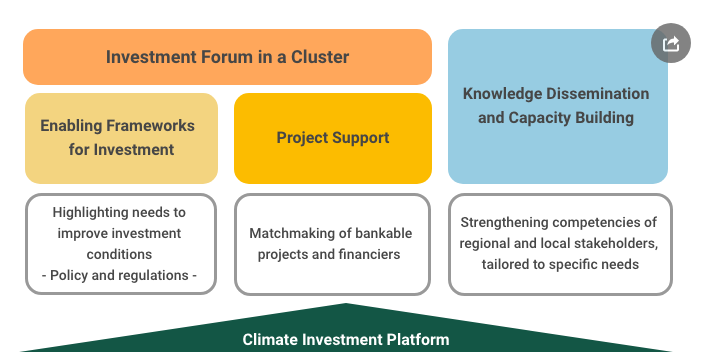

- Robust policies and institutions in support of renewables and energy efficiency: To deliver strong growth of renewables and energy efficiency, governments should establish or empower institutions such as regulators and other relevant agencies and ensure the right frameworks are in place to successfully drive the development of renewables and energy efficiency.

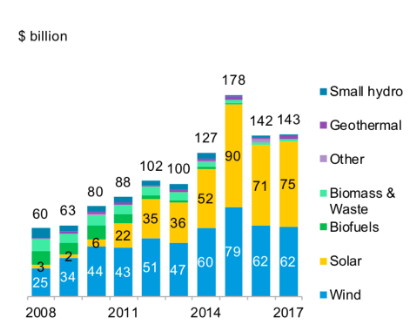

- Shifting electricity sector investments to renewable energy plus storage: For power generation, new investments in renewables are cheaper than new investments in fossil fuels in all major markets today. By adding storage, Caribbean countries can increase resilience, use homegrown energy, avoid creating future fossil fuel stranded assets and reduce the significant negative consequences both to the public’s health and to the fragile ecosystems of the region. With continuing cost reductions, renewables plus storage are now cheaper for many Caribbean countries than conventional fossil fuels – providing reliable power for up to 14 hours a day.

- Invest in energy efficiency: Investment in energy efficiency saves on energy bills, creates jobs and is the cheapest way to reduce emissions. For instance, cold chains are integral to the tourism and agriculture sector of the Caribbean region, and energy efficient cold chain systems would ensure not only significant cost savings for businesses, but also strengthen food security across a region that is vulnerable to various climate risks.

- Ease of doing business: Several activities can be put in place to ensure that investments are driven as fast as possible, including faster approval processes and transparent investment policies (price discovery, reverse auctions etc.) for renewable energy and energy efficiency. Fiscal incentives such as reducing or eliminating import duties and VAT for renewable energy equipment and energy efficient appliances should also be considered."

RSS Feed

RSS Feed